How to Simplify Your Personal Finances

In another life, I wrote process management software for large organizations in the government. These organizations had processes that “evolved” out of years of personal relationships and massive three-ring binders. (It wasn’t until that job that I learned Excel spreadsheets had limits to the rows and columns in a sheet!)

The processes had become extremely difficult to manage, with frequent mistakes, because it was too complicated. It relied on memory and relationships. The leaders of the organizations realized this and tasked us with solving this problem.

Whenever we worked with a new organization, our first task was to document their processes. Then we simplified it. Then we built a process management package that helped them get greater visibility into their process.

When I looked at my own personal finances, I realized I had a similar challenge.

I opened accounts whenever I needed them. I haphazard connected them. I signed up for bank promotions at every turn. I got credit cards and threw old ones in a drawer so they wouldn’t hurt my credit score. It was a mess.

Today, my financial foundation looks well-designed. But it didn’t start out that way.

Like Michaelangelo famously said about the statue of David, you simply chip away everything that isn’t the statue of David. Duh.

So that’s what I did!

Here’s how you can do the same.

Table of Contents

1. Draw Your Financial Map

Before you can improve anything, you need to know what you have.

To accomplish this, we need to draw a Financial Map:

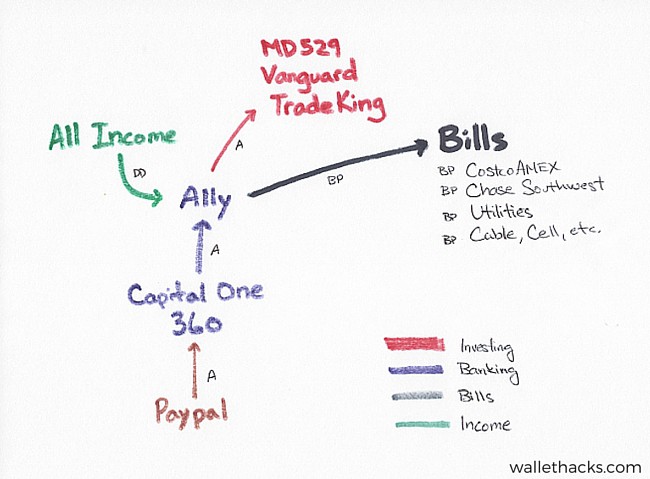

(this map is from years ago – Tradeking was acquired by Ally in 2016 – thus helping me simplify without me having to do anything!)

The first step is to draw your financial map. A financial map is a drawing of all your financial accounts and their relationships. It shows you which accounts are connected, through online links that allow you to initiate transfers, the roles of each, and helps get that model out of your head.

In the map above, you can see that my PayPal is connected to my Capital One 360 account with an A, which stands for ACH. PayPal can push money to Capital One but Capital One can’t push it back. You can see that all of our income flows into our Ally account, which acts as our hub.

It also identifies areas where you have accounts you don’t need and could even help you remember accounts you’ve forgotten. So many instances of Missing Money are bank accounts people forget after they’ve moved.

2. Reshape Your Financial Map

Your map may look like a mess of arrows and circles. That’s OK.

Before you simplify, you want to set up your system within the existing mess. It sounds counterintuitive but you’ll be cutting away accounts. You don’t want to cut and reconnect accounts at the same time.

You want to shape your map with the end result in mind. You do this so that when you start closing accounts, you don’t run into any problems with people paying you or you paying other people, etc.

In building your map, you want a checking account as your hub. In our case, all of our paychecks go into this hub account. All of our bill payments are paid out of this account.

I like designating a single account as the hub so I can see everything in one place. You can opt for whatever you’d like, but the result is that these accounts are keepers.

3. Start Closing & Consolidating Accounts

Once your hub is set, and you can wait a few months to be sure no new transactions occur in other accounts, but then you can start closing accounts. There is no cost or penalty to close a bank account.

With brokerage accounts, there may be a cost for an account transfer. The system is called ACATS, which stands for Automated Customer Account Transfer Service, and some brokers charge a small fee to transfer accounts. This allows you to transfer assets as assets, rather than liquidating them and transferring the cash. A transfer can be better since there are usually no tax implications. If you sell, there is a taxable event. (many brokers will offer a new account bonus to help offset this cost)

If you have 401(k) plans at previous employers, you may wish to roll them over into a Rollover IRA. They’re just like a 401(k) from a tax perspective, you usually get a lot of options. Here are what you should consider when rolling over a 401(k). And if you are intimidated by the process, a service like Capitalize can help you but you can easily do this yourself.

You don’t have to cancel or transfer everything at once. You can opt to do the easy stuff first, like bank accounts, and push off the more involved ones, like brokerages, until later.

As for credit cards, you have a few options if you’re concerned about your credit score. If you intend to need your score (buy a house, car, etc.), don’t do anything with it just yet. If you own a car and own a house, with no near term loan needs, you can take a small hit by closing a credit card. Opt for the newer ones first, so you keep the average history as high as possible, or the smaller credit limits, so you keep your utilization down.

Here is a guide on how to safely close a credit card.

I recommend using only one or two credit cards. Keep your life simple. The added benefit of a third, fourth, or fifth card is rarely worth it. You can stick the rest in a desk drawer if you’re concerned about a lower score from canceling.

Lastly, if you do cancel cards, make sure you increase the credit limits of the others to limit the damage.

4. Redraw & Improve Your Financial Map

Once you’ve pared away some of the fat, redraw your map and think about how you might improve it.

I don’t like trying to improve a process while I’m simplifying it because you can get stuck in the weeds. It may be tempting to try to tweak things here and there but all that time you spend researching may slow down the simplifying process.

The only exception to this is if you decide to select a new checking account hub. If you’ve been using a brick-and-mortar bank with a ridiculously low-interest rate (they all offer horrid rates), switch to an online bank that pays more interest.

5. Update Your “Treasure Map”

I have a document called a “Treasure Map” that explains all of our accounts, why they exist, and where they can be found. The purpose of the map is to explain our financial system in the event I can’t.

If you don’t have one yet, I recommend you create one. The document is simple, creating it can take some time depending on how complicated your financial life is!

By going through this exercise, you are essentially justifying each account to an imaginary third party. You will quickly learn which accounts matter and which can be removed, which can help you in the simplification process.

6. Automate As Much As You Can

After your financial map has been decluttered, you need to automate as much as you can. A simple system is great. A simple system where you’ve automated as much as you can is even better.

I automate my saving, by setting up automatic transfers wherever they need to go, and I automate my bill pay.

I do this for monthly bills, like my utilities, as well as my credit card payments. We don’t carry a balance and our monthly balance is roughly the same (I monitor transactions so I don’t get surprised), so this is routine for us. I don’t need to log into my bank account and pay a utility bill or a credit card. That’s just another thing to forget.

The only bills I pay manually are those that I only see annually, like a heating oil delivery or propane delivery. Everything else is automatic.

7. Digitize Your Records

My post on how to organize your financial documents gives a step by step guide to how to organize the mass of paper you may be getting from your financial institutions, but the key rules are simple.

- Digitize everything. (opt for electronic statements whenever possible)

- Keep the original if it government issued, notarized, personal property, tax or loan related. Shred the rest.

99.9% of the paper you get is useless. And that’s after you sign up for paperless/electronic statements.

I scan it if I can’t download it and I keep the original if the original would be really hard to get.

I don’t think I’ve ever needed most of the paper documents I’ve received.

8. Cut Services You Don’t Need

As you drew your financial map or automated your bill pay, you probably saw some services you were paying for. Consider simplifying your life by cutting those away.

By reducing those expenses, you reduce one other thing to worry about, you save a little extra money, and your finances are just a little more streamlined to what you want.

It can seem like a never-ending process, that’s OK, just keep at it and your life will get easier and easier.

What will you do next to simplify your finances?

Other Posts You May Enjoy:

How to Build Credit By Paying Bills

It’s now possible to build credit without a taking out a credit card or loan. Apps such as StellarFi, Cushion, Experian Boost, and Bilt help you track and pay your monthly bills, and report the payments to the credit bureau. But how does it work, and can paying bills really boost your credit? Learn more.

16 Best Banks For Digital Nomads

Digital nomads need a bank that can help them manage their money while traveling. Critical features include low monthly and foreign transaction fees, global ATM access, the ability to pay bills and transfer funds, and responsive customer support. If you’re a digital nomad or planning to become one, here are 16 of the best banks for digital nomads. Learn more.

Understanding Maslow’s Hierarchy of Financial Needs

Psychology was one of my favorite subjects in school. It was like getting an instruction manual for how people worked.…

How to Freeze (and Unfreeze) Your Credit Reports

If you suspect that you may be at risk of identity theft or credit fraud, it’s critical that you take action to protect your creditworthiness. One step you can take is to temporarily freeze your credit report. When you no longer need the freeze, you can also unfreeze it. Find out how to freeze (and unfreeze) your credit reports.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.